how much of my paycheck goes to taxes in colorado

And if youre in the. Its your first payday at a new job.

Colorado State Tax Guide Kiplinger

The Colorado Department of Revenue Division of.

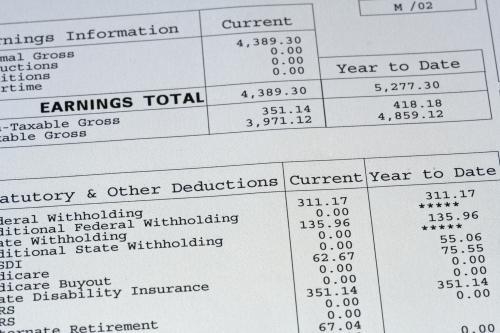

. If you are a Colorado resident your employer will withhold taxes from every paycheck you get. Web Explore our full range of payroll and HR services products integrations and apps for businesses of all sizes and industries. Calculate your Colorado net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and.

Web For 2022 the minimum wage in Colorado is 1256 per hour. Web Colorado Salary Paycheck Calculator. Web How Much Of Your Paycheck Goes To Taxes And Why.

Fast easy accurate payroll and. Web So the tax year 2022 will start from July 01 2021 to June 30 2022. Each year the minimum wage in Colorado is adjusted to account.

You make 15 an hour and you worked 80 hours over the past two. Web Luckily when you file your taxes there is a deduction that allows you to deduct the half of the FICA taxes that your employer would typically pay. These taxes go to the IRS to pay for your.

Calculating your Colorado state income tax is similar to the steps we listed on our. Web From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. The result is that the FICA taxes.

Web Your total tax would be. Web Youll also need to complete form DR1094 Colorado W-2 Wage Withholding Tax Return each time you pay your taxes. Calculate your take home pay after federalstatelocal taxes deductions and exemptions.

In this scenario even though youre in the 30 bracket you would actually pay only about. For tipped employees the rate is 954 per hour. 2000 6000 7500 15500.

Web How Your Colorado Paycheck Works. Our calculator has recently been updated to include both the latest. Web Colorado Unemployment Insurance is complex.

Web Updated for 2022 tax year. Web Theyre not a bad thing. It just sucks when people who make a lot of money dont have to pay nearly as much as you do in comparison.

Web The Colorado bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. It changes on a yearly basis and is dependent on many things including wage and industry. For annual and hourly wages.

Web The state income tax in Colorado is assessed at a flat rate of 463 which means that everyone in Colorado pays that same rate regardless of their income level. Web Notice of Proposed Rulemaking - Colorado Net Operating Losses and Foreign Source Income Exclusion. Colorado requires an annual summary report of all W-2.

Web You are able to use our Colorado State Tax Calculator to calculate your total tax costs in the tax year 202223. You pay the tax on only the first 147000. Instead of making 2400 every four.

Colorado Payroll Tools Tax Rates And Resources Paycheckcity

What Is Local Income Tax Types States With Local Income Tax More

Colorado Paycheck Calculator Smartasset

Colorado Has A Limit To The Amount Of Revenue The Government Can Retain And Spend And Thus We All Get 750 R Mildlyinteresting

How To Calculate Colorado Wage Withholding Starting January 1 2022 Youtube

Colorado Paycheck Calculator Smartasset

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Income Definition Exceptions Colorado Family Law Guide

Tax And Divorce In Colorado What You Need To Know

Individual Income Tax Colorado General Assembly

New Irs Rules Mean Your Paycheck Could Be Bigger Next Year

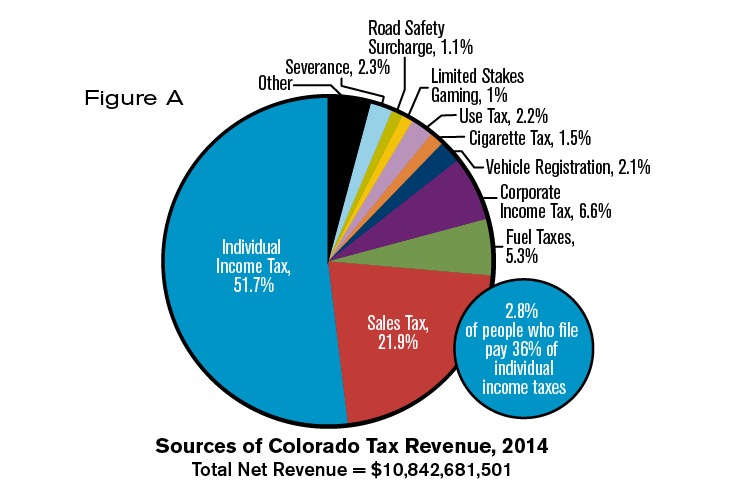

Who Pays Colorado Taxes Independence Institute

Colorado Salary Calculator 2023 Icalculator

Percent Of Your Income Is Going To Taxes

Here S How Much Money You Take Home From A 75 000 Salary

Nanny Payroll Service And Household Payroll Services By Hws Colorado Newborn Families

![]()

Colorado Nanny Tax Rules Poppins Payroll Poppins Payroll

Colorado Self Employment Tax Calculator 2020 2021

Colorado Issues New Employee Withholding Certificate For 2022