main street small business tax credit ii

HttpswwwcdtfacagovThe California Department of Tax and Fee Administration CDTFA administers Californias sales and use fuel tobacco and other tax. The new tax credit program provides financial relief to qualified small.

Eckhoff And Company Eckhoffcpa Twitter

Main Street Small Business Tax Credit II.

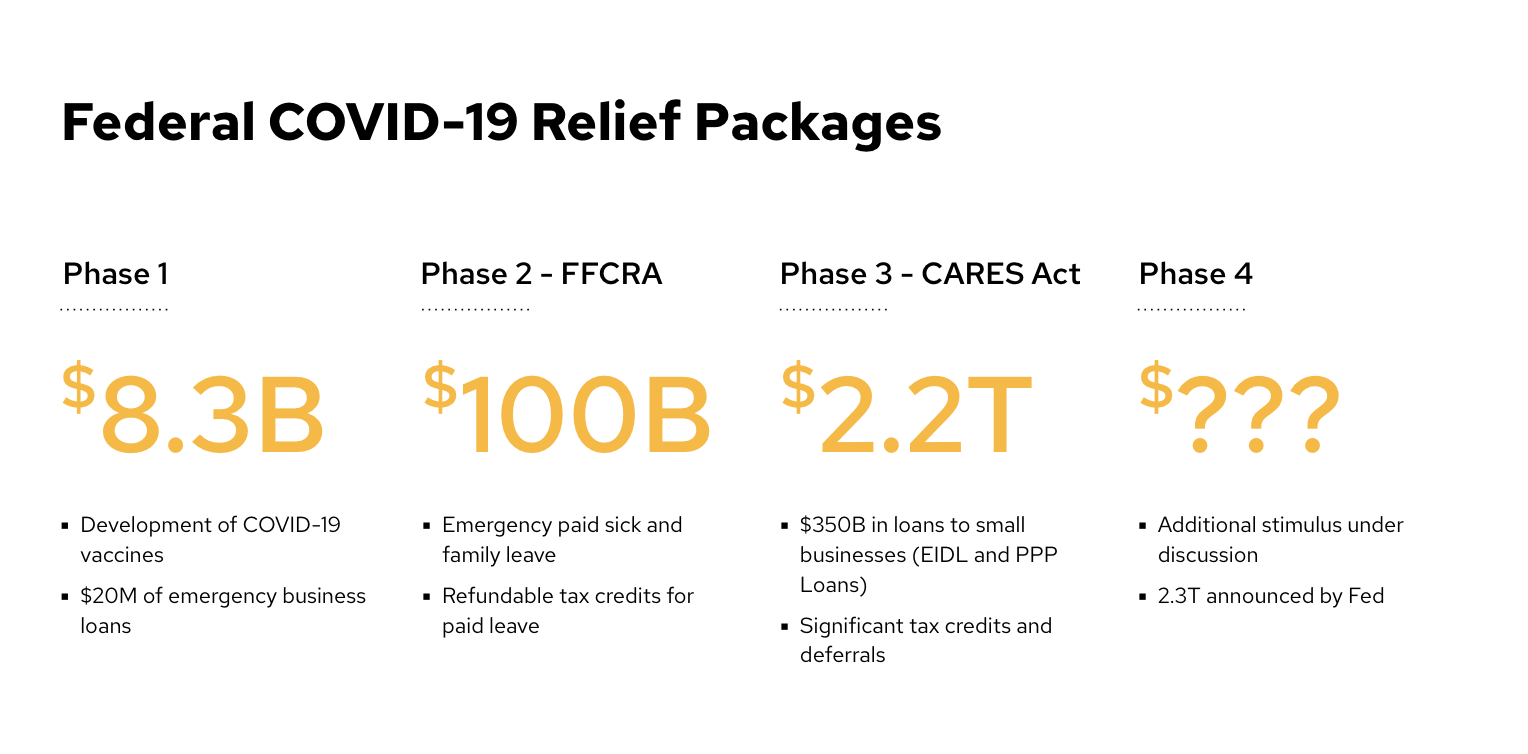

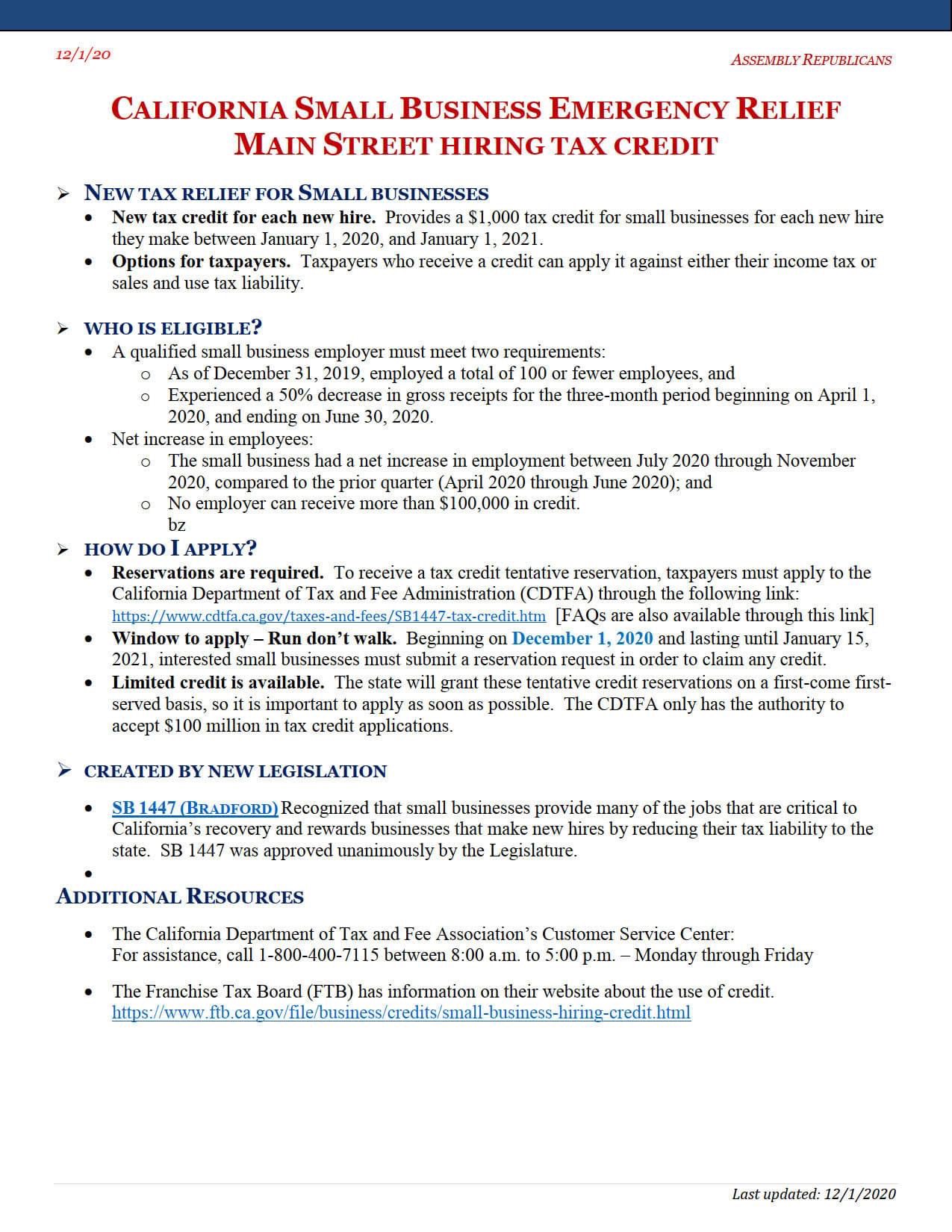

. California has passed Assembly Bill AB 150 establishing the Main Street Small Business Tax Credit II. Governor Gavin Newsom recently signed Assembly Bill AB 150 which establishes the Main Street Small Business Tax Credit II. Tax credits available include.

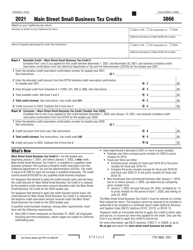

The 2021 Main Street Small Business Tax Credit II reservation process is now closed. But to claim the tax credit on a 2022 state income tax return businesses must apply before Dec. Online Services for Businesses.

This will provide financial relief to qualified small. You can apply for a reservation at 2021 Main Street Small Business Tax Credit II. A tentative credit reservation must be made with.

The Main Street Small Business Tax Credit II may be used to offset income tax or sales tax by making an irrevocable election. Californias governor signed Assembly Bill AB 150 establishing the Main Street Small Business Tax Credit II. Senate Bill 1447 was enacted on September 9.

Welcome to the California Department of Tax and Fee Administrations 2021 Main Street Small. You can find more information on the Main Street Small Business Tax Credit Special Instructions for Sales and Use Tax Filers page. The federal Work Opportunity Tax Credit WOTC provides a credit of up to 40 percent or 2400 on the first 6000 in wages paid by employers for hiring and.

1 may be claimed on the 2023 tax return. Treasury posted a request for information RFI in the Federal. New York Business Express NYBE DTF-215 Recordkeeping Suggestions for Self-employed Persons en Español Recapture of tax credits.

The California government announced Main Street Small Business Tax Credit II on November 1 2021 to offer further financial aid to small businesses struggling to make. The Main Street Small Business Tax Credit II will provide COVID-19 financial relief to qualified small business employers. On November 1 2021.

The Main Street Small Business Tax Credit II will provide Covid-19 financial relief to qualified small business employers. SSBCI NEWS Recent SSBCI News and Announcements from the last 60 days. Main Street Small Business Tax Credit II.

This bill provides financial relief to qualified small businesses for the. Tax credits issued after Jan. The total amount of credit available is approximately 116 million and will be allocated on a first-come.

Payroll Systems Covid19 Updates Payroll Systems

Financing And Incentives Njeda

Main Street Small Business Tax Credit Ii

Small Business Tips Blog Surepayroll Blog

The Small Business Owner S Guide To Federal Aid Rippling

Main Street Small Business Tax Credit Available For Cal Businesses

What Is The Main Street Small Business Tax Credit Tax Hive

Form Ftb3866 Download Fillable Pdf Or Fill Online Main Street Small Business Tax Credits 2021 California Templateroller

Business Tax Accountant Advocate

Main Street Small Business Tax Credit Available For Cal Businesses

State Tax Credit And Incentives Update Marcum Llp Accountants And Advisors

From Relief To Recovery Using Federal Funds To Spur A Small Business Rebound Stage 2 Recovery

Senator Shannon Grove On Twitter Earlier This Year I Supported Sb1447 To Bring Much Needed Help To Our Small Businesses Are You A Small Business Owner Check Out The Fact Sheet Below

Hurt By Lockdowns California S Small Businesses Push To Recall Newsom The New York Times